Harbour House Towers Condominium Apartments (HHT)

ADMINISTRATIVE PROCEDURES BINDER

Procedure 05 – Collection of HHT fees –As of

2013-02-02

One of the primary responsibilities of the HHT Board of Directors is collecting the revenues and paying the bills. To guide and assist the HHT Board in accomplishing these duties, the Bahamas Condo Act and the HHT Bylaws provide the Board with certain powers and legal recourses. For example, the HHT Bylaws states at article 17(c) that: “If the maintenance charges so levied shall remain unpaid for a period exceeding Ninety (90) days it shall be the duty of the body corporate to initiate proceedings in a court of competent jurisdiction as provided by Section Eighteen (18) (2) of the Act.” Therefore, the Board has a legal obligation to initiate lien procedure once a unit is more than 90 days overdue.

Even though it is the owner’s responsibility to know and fulfill its obligations towards HHT, the HHT Board and its administrative personnel can facilitate the collection of fees by providing timely and accurate billing information, and early warning in case of delinquency. The 2012-13 Board has updated and documented the following procedure to address these points.

HHT COLLECTION PROCEDURE & ADMINISTRATIVE CALENDAR

- Condo maintenance fees are due the 1st of the month for which they are invoiced and should be paid before that date. This has been a long standing policy at HHT as it is for a majority of condo properties.

- To allow owners two weeks to send their payment in time to meet the 1st of the month due date, on or around the 15th of the preceding month, HHT will invoice on the monthly statement the maintenance fees effective and due the 1st of the following month. For example: the August 2012 fees, due the 1st of August 2012, would be invoiced on the monthly statement on or around the 15th of July 2012. On that same day, prior to invoicing the monthly maintenance fees, delinquent interest charges, due the 1st of the following month, will be computed monthly and invoiced on the monthly statement. All other fees will be invoiced by email as they occur and will be due the 1st of the following month. These invoices will be listed on the cumulative statement that will be emailed to each owner on or around the 15th of the month. Starting with the July 15, 2012 statement, the due date of the invoice, when applicable, will be printed beside the invoice number. Below the invoice number, the object of the invoice will be printed. On the monthly statement, HHT will also print information advising owners mailing checks to HHT from outside the Bahamas to use the following HHT USA mailing address to expedite the delivery: Harbour House Towers, 2800 SW 4th Avenue Unit 4, Fort Lauderdale, FL, USA, 33315. The above note regarding the HHT USA mailing address should also appear on all HHT invoices.

- At the bottom of the statement, the “CURRENT” amount due, the past due amounts and the total “Amount Due” are indicated. Owners should pay the total “Amount Due” indicated in the bottom right corner of the statement.

- If a payment is made in US currency, owners MUST add 1% to the total amount due to cover the currency conversion fees from US dollars to Bahamas dollars. Starting with the September 2012 invoicing, HHT will add the following narrative at the bottom of each statement: “Please pay “Amount Due” in the bottom right corner. / If payment in US dollars, please add 1% to the total to cover the currency conversion to Bahamas dollars.”

- On the 15th of each month, interest at 18% per annum will be charged on all overdue invoices.

- To forewarn owners that are delinquent, between the 17th and the 19thof each month, using QuickBooks collection center, HHT accounting will produce a listing of all HHT delinquent owners with the number of overdue days of their most overdue invoice. Then, it will categorize delinquent owners as follow: 31-60 Days, 61-90 Days and over 90 Days. Then,

- The 31-60 Days email (text below) will be sent to all delinquents in that category.

- The 61-90 Days email (text below) will be sent to all delinquents in that category.

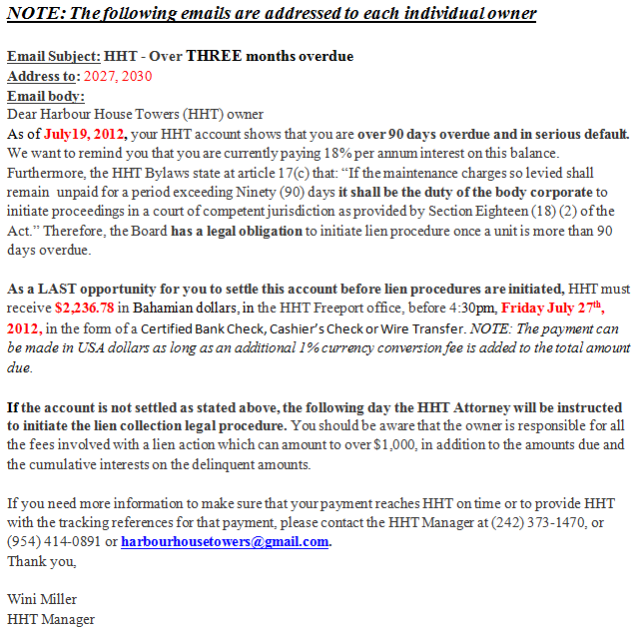

- The over 90 Days email (text below) will be sent to all delinquents in that category. The payment deadline should be seven days from the email date. The amount should be the total delinquent amount for that Owner.

- NOTE: The same above procedure should be done prior to a Board Meeting to obtain the listing of all delinquent Units by category to be documented in the Board Meeting Agenda and Minutes.

- IMPORTANT NOTE: HHT is not compelled to send warnings to late paying owners. HHT does it as a courtesy. In NO WAY an owner can use the fact that he did not receive a warning from HHT for not paying its accounts on time once he has been invoiced.

- Delinquent owners that are over 90 days past due will receive an email from HHT advising them that if their full payment of the due amounts and fees, in the form of a Certified Bank Check, Cashier’s Check or Wire Transfer, is not received within the calendar week (7 days) in the HHT Freeport office, the account will be sent to the HHT Attorney with instructions to initiate the lien collection procedure. The day after a 90 days plus delinquent owner has not complied with the HHT one week warning email; HHT will send the owner’s collection file to the HHT Attorneys to initiate legal action. Owners are responsible for all the fees involved with a lien action which can amount to over $1,000, in addition to the amounts due and the cumulative interest on the delinquent amounts.

- Chronic Delinquents – The regular collection procedure described herein applies to owners who pay on time or may occasionally be late or slip a payment. Unfortunately, HHT has a few CHRONIC DELINQUENTS: owners that are constantly overdue and are often over 90 days overdue. This paragraph applies to these CHRONIC DELINQUENT owners. A CHRONIC DELINQUENT owner is defined as someone who has in the past, and more specifically in the last twelve months, fallen three months overdue more than once. The second time, during a consecutive twelve month period, an owner becomes over 90 days overdue, his account will automatically be sent to the HHT Attorney to initiate the Lien procedure without additional warning from HHT. The owner will incur the legal fees involved and will have to pay the entire amount overdue to avoid lien action. HHT will not accept being taken advantage of by CHRONIC DELINQUENT owners with all the administrative work it imposes on its staff and Board.

- On the day following the payment deadline set for the over 90 days overdue accounts, the HHT Manager will email (text below) the HHT Attorney the accounts to be put on lien with carbon copies to the HHT President and Treasurer.

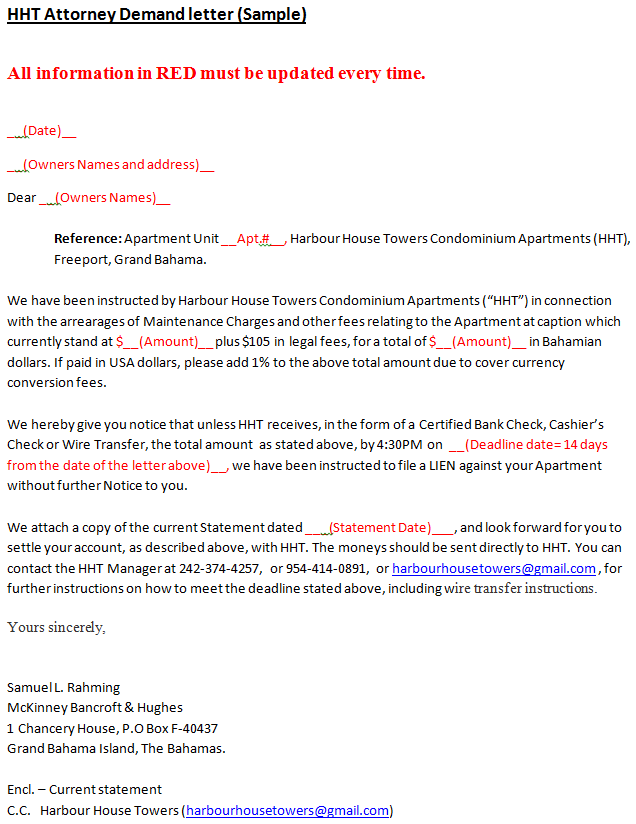

- The HHT Attorney will send a collection letter by email and FedEx to the unit owner(s) requesting payment by a specified date (14 day notice). At that time, HHT will add that Attorney’s letter fees $105 “Demand Letter” fees (July 2012 Fee) plus the FedEx fees a $100 “FedEx” fee (July 2012 Fee), to the owner’s account. These fees are added to the amount to be paid by the owner to stop the lien procedure.

- Once 15 days have elapsed, from the day that the account was sent to the HHT Attorney, the HHT Manager will inform the HHT Attorney if a payment was received or not. If a complete payment was received, the Attorney will be instructed NOT to file the legal lien. If the complete payment was not received at the HHT office, the Attorney will proceed TO FILE the legal lien with the authorities. At that time, HHT will add $548 “Record Lien” fees (July 2012 Fee) and $238 “Withdraw Lien” fees (July 2012 Fee) to the owner’s account to cover the legal fees to put in and later remove the lien. These fees are added to the amount to be paid by the owner to stop the lien procedure.

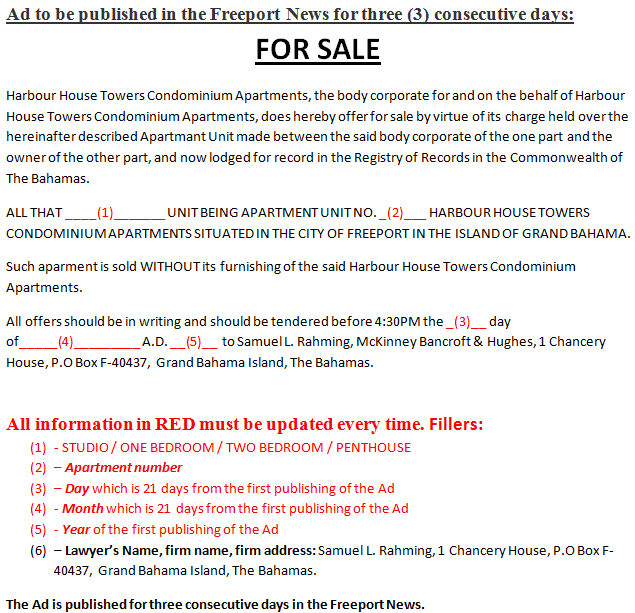

- Once the Attorney confirms to HHT that the lien has been lodged for record with the proper authorities, the HHT Manager will put a FOR SALE Ad in the Freeport News as per the example below. At that time, HHT will add to the owner’s account the costs of the Ad of $285.30 “Newspaper Lien Ad” fees (July 2012 Fee). This fee is added to the amount to be paid by the owner to stop the lien procedure.

- HHT will email and FedEx (only if the lien demand letter was not FedEx) the owner under lien (text below), with email Cc to the HHT Attorney, the details of the payment amounts and methods using the email format below along with a copy of the Attorney’s collection letter. At that time, HHT will add the $100 “FedEx” fee to the owner’s account to be paid by the owner to stop the lien procedure.

- HHT will email the lien Ad to the HHT owners (text below), to increase the potential number of bidders, since quite often HHT condos are purchased by acquaintances of owners looking to join them in Freeport.

- If HHT receives complete conform payment before the deadline published in the newspaper has expired, HHT will inform the Attorney of the payment. The Attorney will remove the lien on the owners’ property and inform the bidders of the conclusion. He will then file the documentation for future reference.

- Once the deadline in the Ad has expired, if no conform payment has been received, a bid opening meeting will be scheduled at the lawyer’s office where two HHT Board members will join the Attorney for the opening of the bids. Once the bids are opened, the property will be sold to the highest bidder, provided that the highest bid is enough to cover all amounts and fees due, or the bids will be rejected and the sale process will be re-initiated. Once awarded, the Attorney will complete the sale.

- The amounts due to HHT, including all the fees and interest charges, will be deducted from the proceeds and the balance reimbursed to the owner(s).

NOTE: Unless otherwise requested in writing by an owner, all amounts received by HHT are applied to the oldest due invoices.

Dockage Fees

As per a 2005 AGM resolution, dockage fees have to be invoiced along with the other condo fees. Therefore, on December 15 every year, the dockage fees have to be invoiced to owners renting dockage space.

Storage Rental Fees

Annual storage rental fees should be invoiced annually along with the other condo fees. Therefore, on December 15 every year, the annual storage rental fees have to be invoiced to owners renting storage space.

1% US$ to BA$ Currency Conversion Fees and Posting

All amounts due to HHT are in Bahamas dollars. If a payment to HHT is made in US$ currency, HHT must charge the owner the 1% charged by the bank for currency conversion from US dollars to Bahamas dollars. The same would apply for any other currency conversion. This 1% is to be charged to the unit at the time of the deposit. When doing the bank reconciliation in QuickBooks, HHT accounting must verify that the 1% currency conversion charges have been invoiced to each owner. If not, it should be done at that time.

Others fees charged to owners

Any other fees recoverable from owners must be posted when incurred and are due the 1st of the following month.

Posting of ALL Owners’ Charges into QuickBooks

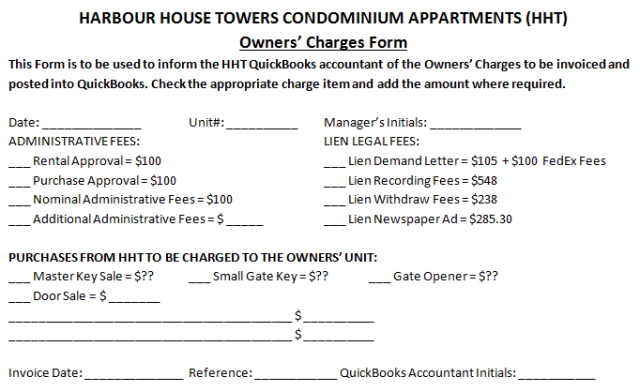

For posting any Owners’ Fees and Charges into QuickBooks, the Manager will complete the “Owners’ Charges Form” below and deposit this completed form into the HHT QuickBooks accountant “Inbox”. The QuickBooks accountant will input the information into QuickBooks and invoice the charges to the Unit. Once done, he will file the documentation in the Owners’ Charges folder sequentially by date.

Recoverable Lien & Legal Fees posting

- When HHT sends an email to the HHT Attorney to initiate a Lien procedure, HHT must charge the owner’s account $105 “Demand Letter” fees (July 2012 Fee) plus $100 “FedEx” fees (July 2012 Fee).

- When a legal Lien on the unit is prepared, signed, stamped and lodged for record by the Attorney, HHT must add $548 “Record Lien” fees (July 2012 Fee) and $238 “Withdraw Lien” fees (July 2012 Fee) to the owner’s account.

- When HHT sends an Ad to Freeport News, HHT must add to the owner’s account the costs of the Ad of $285.30 “Newspaper Lien Ad” fees (July 2012 Fee).

- If there are any other recoverable fees, they must be added to the owner’s account when incurred.

HHT 5% discount on annual maintenance fees requirements

For owners paying their entire year maintenance fees in early January:

-

Applicable only on maintenance fees (as it has always been). DOES NOT apply to any other HHT charges including assessments.

- Owners need to have Proof of Ownership on file in the HHT office.

- Owners have to be current in the payment of their condo fees, meaning they need to have fully paid ALL their HHT fees due prior to December 31st of the preceding year.

- The twelve month’s maintenance fees less the 5% discount have to be fully paid by January 15th.

Collection Procedure – Daily collection actions:

Sequence

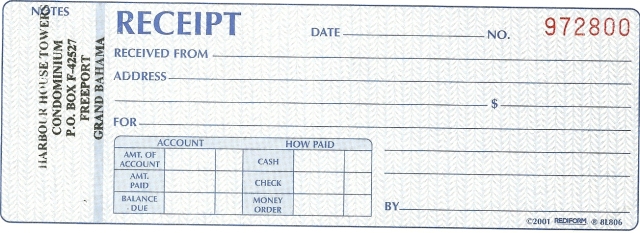

- Upon any type of payment, except for the sale of washing machine tokens, the Manager fills out a receipt in the receipt book;

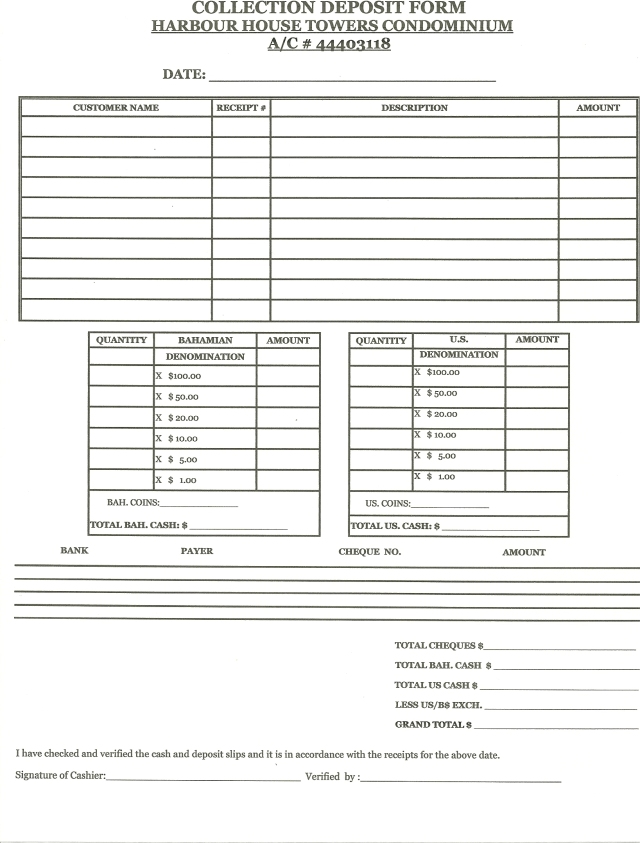

- At the end of each day, using the receipt book, the Manager fills out the “Collection Deposit Form”;

- When ready to make a deposit, using the “Collection Deposit Form”, the Manager fills out the deposit book;

- The Manager makes the deposit or drops it using the Night Drop Envelope;

- Once the deposit book is retrieved, the Manager makes a copy of the deposit page and attach it to the “Collection Deposit Forms” for that deposit;

- The Manager then drops those documents into the QuickBooks accountant inbox.

- The QuickBooks accountant posts the deposit and files the documents in the deposits file folder. These documents will serve for the bank reconciliation and annual audit.

- Once the monthly bank report has been received the QuickBooks accountant will reconcile the bank account.

The above approach insures that there is a clear audit trail for deposits and maximizes the office productivity through clear and explicit documentation, requiring minimum human interventions, and a clear delimitation of responsibilities.

Payments

NOTE – Regarding direct deposit payments: Owners making direct deposit payments are asked to send HHT a copy of their direct deposit receipt. HHT needs to validate with the bank that the direct deposit has been made, the amount, the currency and the date. Then, HHT needs to enter the payment details into the “Receipt Book” as it does for all the other payments.

The receipt must indicate:

- The date the payment is received;

- The unit # & Owners’ name;

- The total amount and how it is split amongst several invoiced items (Ex.: Maintenance for this and that unit, dockage, item sold,…);

- In the “How Paid” box HHT must indicate the currency, if other than B$. This will be used by accounting to charge the 1% currency conversion fee.

- The receipt must be signed by who received the payment.

- Finally, the top bluish copy of the receipt must be given to the payer or filed in the unit folder.

Receipt Specimen:

What is an invoice?

Whether it is for the supply of goods or the provision of services (or for both), the purpose of an invoice is twofold: it is an official record of that sale to the customer and in effect, is most often the very first request for payment made to the customer. Accuracy and promptness are vital on both counts. As a true record of the sale, the invoice must be correct in every aspect, and in order to ensure payment on the due date, it should be issued without delay to the customer.

The purpose of an invoice is essentially to inform a customer how much he owes, by when it should be paid, and exactly to where it should be paid.

Posting in QuickBooks

Payments from owners must be posted with the date of their receipt and at the latest the following day of their receipt. This is to insure that owners do not get charged improper late fees due to inaccurate posting date.

Other revenues (Tokens, Keys, Gate Openers,…)

In addition to collecting owners condo fees, HHT also sells washing machine tokens, main door keys, Gate Openers, etc.… Since a significant cash amount is transacted this way, proper accounting procedures must be in place to ensure accurate accounting for these revenues.

Washing Machines Tokens

The HHT Manager has the responsibility of managing the sale of washing machine tokens by the office and security personnel. The HHT Manager must record these sales using the “Washing Machine Tokens” form. These revenues should be deposited in the HHT current bank account and posted in QuickBooks by the QuickBooks accountant. The “Washing Machine Tokens” form must show deposits. Each deposit must be recorded as an entry on the “Collection Deposit Form” and a copy the “Washing Machine Tokens” form must be attached.

Keys, Gate Openers and convenient items sold by HHT

The HHT Manager has the responsibility of managing the sale of keys, gate openers and convenient items sold by HHT. For cash sales, the HHT Manager must produce receipts from the HHT receipt book and record these sales as an entry on the “Collection Deposit Form”. For sales to be charged to the Owners’ Unit, use the Posting of ALL Owners’ Charges into QuickBooks procedure herein.

MONEY COLLECTION PROCEDURE – Revised November 21, 2014

All monies collected WHETHER cash, cheques, internet or wire transfer for maintenance, clickers, fobs and key cards, MUST have a receipt written with full details, properly dated and given to owner/tenant. If wire or internet transfer receipt MUST be put into owner file immediately.

All receipts, including those made up for wire and internet transfers and voided receipts, MUST be listed sequentially on the Collection Report.

IF A DEPOSIT IS VOIDED FOR ANY REASON BOTH COPIES ARE TO BE LEFT IN THE DEPOSIT BOOK WITH FULL EXPLANATIONS.

COLLECTION RECORD SHEET MUST be prepared by Admin. Assistant

This is to be written up daily showing:

- Date

- Receipt no.

- Name

- Maintenance apt.

- Other

- Cheque no.

- US$ cheques

- B$ cheques

- Cash

ALSO:

- Column totals for B$ and US$ cheques and cash total, subtotal, exchange and bank deposit total.

- Copies of cheques MUST be attached to relevant Collection report.

- The Collection Report MUST be totalled when amount is being deposited and signed by the Admin. Assistant and witnessed by the Manager.

- ALL receipts pertaining to deposit to be initialled by both Manager and Admin. Assistant.

- The bank deposit is to be made up by the Administrative Assistant and initialed and witnessed by the Manager.

- Before going to the bank the deposit sheet MUST be copied and attached to the Collection Report.

- Once money has been deposited, the copy of the deposit stamped and signed by the bank, MUST be copied and also attached to the applicable Collection Record Sheet.

- NO DEPOSIT SLIPS ARE TO BE REMOVED FROM THE DEPOSIT BOOK UNDER ANY CIRCUMSTANCES.

- DEPOSIT DROPS AT THE BANK MAY ONLY BE DONE ON A FRKAY IF NECESSARY.

TOKEN MONEY

- A separate deposit to be written following the same procedure as shown above.

BY ADHERING TO THIS PROCEDURE THERE WILL BE BETTER CONROL AND PAPER TRAIL.

BANKING

Deposits

Bank deposits must be made by the Manager every time HHT receives material payments (cumulative cash amount over $1,000) or a maximum of two days after reception of a payment. Deposits must be immediately posted into QuickBooks by the QuickBooks accountant.

Bank reconciliation

In the following two days after HHT receives the monthly bank report for each HHT bank account, the bank statement must be reconciled by the QuickBooks accountant in QuickBooks. The HHT QuickBooks accountant must try to get a computer printout of the bank statement at the beginning of the month, in order to balance the bank shortly after the 1st of the month instead of waiting to get the bank statement in the mail.

Collection Deposit Form

Once money (cash, checks,…) has been received and a receipt produced, that money to be deposited must be entered onto the “Collection Form” below.

Deposit Book

When it is time to make a deposit, using the “Collection Forms” the deposit is entered into the “Deposit Book”. Then, the money and the Deposit Book are inserted into a “Deposit Envelop” to be either deposited or dropped into the night deposit box at the Bank.

Once a deposit has been made, the depositor must attach a copy of the deposit book page with the Collection Deposit Forms and put these documents in the QuickBooks accountant “Inbox” for posting into QuickBooks.

Missing: Copy of deposit book blank page

QUICKBOOKS SETUP AND POSTING REQUIREMENTS

Delinquent interests computing

QuickBooks should be setup so that all HHT issued invoices are “Due the 1st of the month”. Delinquent interest at 18% per annum is computed on the 15th of the month, prior to invoicing the monthly maintenance, on all unpaid invoices.

Delinquent interest charges and the monthly maintenance fees are invoiced on the monthly statement (not on a separate invoice).

All other invoices are invoiced on the day they occur and are to be emailed to owners on that same day.

Computing the monthly maintenance fees from the budget

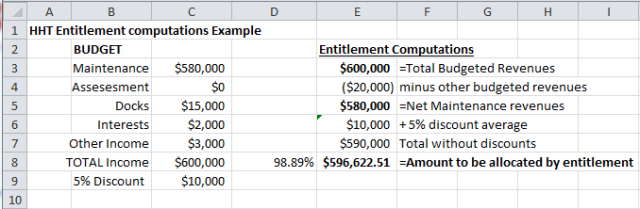

Once a new budget goes into effect after being approved at an AGM, the amount to be collected from each owner must be computed as follows:

- From the total budgeted revenue amount, the other revenue sources such as “Dockage”, Interests” and “Other Income” must be subtracted from the total budgeted revenue.

- Then, the past years average of the 5% discount on maintenance fees must be added to the revenues to be collected, since it represents a deduction from the income.

- Then, since HHT does not have a commercial area for which there is a 1.11% entitlement, the expected revenues have to be brought back to a 100% basis. This is done by dividing the budgeted income to be invoiced by 98.89%. The result of this computation is the amount to be multiplied by each unit entitlement percentage.

- In a spreadsheet, take the amount computed in (3.) and multiply it by each unit entitlement percentage. The sum minus the 5% discount should equal the maintenance fees collection budgeted amount.

Invoicing January on the December 15th Statement

On the 1st of January each year, HHT has to invoice the following:

- Invoice the applicable delinquent interest charges;

- Invoice the monthly maintenance fees without the 5% discount (that 5% discount was for the year ending December 31st);

- Invoice the annual Dock Slips Rental fees;

- Invoice the annual Storage Rental fees;

- Invoice any other applicable fees.

Therefore, on or around December 15, the following sequence needs to be followed:

- Compute and invoice the 5% delinquent interests charges;

- Invoice the annual Dock Slips Rental to applicable owners;

- Invoice the annual Storage Rental to applicable owners;

- Remove the 5% discount applicable to qualifying owners;

- Invoice the monthly maintenance fees to all owners;

- Invoice any other applicable fees;

- Produce and email the statement, showing all of the above, to all owners.

Invoicing February on the January 15th Statement

Before starting to invoice:

- Get the mail from the post office and Arising Courier on the 16th of January to ensure HHT has all the owners’ payments.

- Have the bank account checked in the morning on the 16th of January for owners’ direct deposits.

- Post ALL payments received before doing anything else.

Once HHT is sure it has all the owners payments received before the end of the business days on January 15th, it can proceed to do the following:

- Check that all receipts have been posted in QuickBooks.

- Produce an A/R Aging Summary report, in excel format, to obtain the total advance money for each units.

- Using the excel A/R Aging Summary report spreadsheet, do computations to determine which units have enough money to cover the payments for the rest of the year maintenance fees once you deduct the 5% discount. The resulting list of units will qualify for the 5% discount.

- Now, compute the delinquent interest charges.

- In QuickBooks, setup the 5% discount for the rest of the year, for the units that qualify.

- Write down the 5% discount amount computed by QuickBooks for February for each qualifying unit.

- Credit each 5% qualifying unit, the 5% amount noted above, as the 5% discount due on their January invoice. (“5% discount for January”)

- Produce the February statement showing all of the above and email it to ALL owners.

FOLLOWING ARE DOCUMENTS REFERRED TO ABOVE:

INVOICE LABELS:(Below the invoice number)

Monthly Maint. – For monthly condo fees

Annual Dockage– For annual dockage fees

Foreign Exchange – Currently = 1% of the amount exchanged.

Demand Letter – For invoicing the 14 days lawyer’s notice letter = Currently = $105

Record Lien – For invoicing putting & removing the lien = Currently = $548

Withdraw Lien – For invoicing putting & removing the lien = Currently = $238

Newspaper Lien Ad – For invoicing the costs of the lien Ad in the Freeport News = Currently = $285.30

FedEx Lien – For invoicing the costs of the FedEx sent to the owner = Currently = $100.

Door Purchase– Currently=$